|

|

||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Ecomm.sg : Ecommunicating Investment Trading Ideas

SG 60 Ecomm Promotion

For Existing Ecomm Subscribers:

For Non-Subscribers:

* And be entitled to sign up 2026 full-year subscription at the discounted renewal fee of $80 (Usual price: $180).

Ecomm现有订户 (Existing Subscribers):

以下是我们每日内容的其中的片段。会员可以用ID和PASSWORD进入网站阅读最新完整的内容.

The following are excerpts of our past daily updates. Members may login using ID and password to view our latest full market updates.

Recent Market Update Excerpts:

09-08-2025 (Sat) 8.00am

25-07-2025 (Fri) 7.45am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: " 中国副总理何立峰将于7月27日至30日赴瑞典与美方举行经贸会谈。这是个很好的消息。

新加坡有史以来第一次政府不断出台提振股市的措施,股市已连涨14个交易日,连创新高,气势如虹。这和当初中国和香港的政府不断出台提振股市一样,到现在中港股市还在上涨中。"

(所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: " Chinese Vice Premier He Lifeng will go to Sweden to hold economic and trade talks with the United States from July 27 to 30. This is very good news.

For the first time in history, the Singapore government has continuously introduced measures to boost the local stock market. The local stock market has risen for 14 consecutive trading days, setting new record highs on a strong sentiment. It is the same with the Chinese and Hong Kong governments, who have continuously introduced measures to boost their own stock markets. The Chinese and Hong Kong stock markets are also still on the rise. "

23-07-2025 (Wed) 8.00am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: " 新航工程(SIA Engineering)第一季营业盈利同比从410万元增至510万元,净利同比上升29.2%至4290万元,营收也大增33.4%至3亿5840万元。业绩报告称客运量的持续增长,尤其是亚太地区的客运量,预计将继续推动飞机维护、修理和翻修(MRO)需求。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: " SIA Engineering reported an increase in first quarter operating profit from $4.1 million to $5.1 million year-on-year, net profit increased 29.2% year-on-year to $42.9 million, and revenue also increased 33.4% to $358.4 million year-on-year. The financial report stated that the continued growth in passenger traffic, especially in the Asia-Pacific region, is expected to continue to drive demand for aircraft maintenance, repair and overhaul (MRO).

22-07-2025 (Tue) 8.15am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: " 今年2月新加坡宣布推出总额50亿元的证券市场发展计划,以及第一阶段的股市提振措施。7月21日新加坡金融管理局又公布第一批证券市场发展计划(EQDP)下的三家资产管理公司,一共投资11亿元。第一批被选中的资产经理人分别是Avanda Investment Management、富敦资金管理公司(Fullerton Fund Management)和摩根大通资产管理(J.P. Morgan Asset Management)。 新加坡对市场的这种措施都是前所未有,显示政府有决心提振低迷的股市,也要应付关税的冲击。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: " In February this year, Singapore announced the launch of a $5 billion Equity Market Development Programme, as well as the first phase of stock market supporting measures. On July 21, the Monetary Authority of Singapore announced the first batch of three asset management companies under the Equity Market Development Programme (EQDP), with a combined initial sum of $1.1 billion invested with them. The first batch of selected asset managers are Avanda Investment Management, Fullerton Fund Management and J.P. Morgan Asset Management. Such market supporting measures in Singapore are unprecedented, showing that the government is determined to boost the sluggish stock market and also cope with the impact of tariffs.

21-07-2025 (Mon) 8.25am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: " 黄仁勋指出美国对中国的反制反而让中国发展另外一套AI,最后可能反而取代美国。商业部长来自汐谷,也赞成他的说法。而特朗普急着要见习近平,反而成了其团队中最不鹰派的人,黄仁勋终于说服了特朗普,可以卖H20给中国了,这是很难得的一件事,中美的紧张关系也较缓和一些。最近的世界天天在变,我们也要跟着改变,才能脱颖而出。 英国泰晤士报报道,习近平拟邀请特朗普和普丁出席中国抗战80周年阅兵,可能举行三国峰会,这件事已传闻多时,如果成行,将轰动全世界,也是对全世界局势产生重大的影响,对股市应是大利好。 " (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: " Jensen Huang said that the US countermeasures against China will spur growth of domestic capabilities in China that will eventually rival and replace those created by the US technology industry. Trump is eager to meet Xi Jinping, and has become the least hawkish person in his team. Jensen Huang finally convinced Trump to allow Nvidia's H20 chips to be sold to China. This is a rare feat, and the tension between China and the United States has eased. The world is changing, and we need to change with it. British newspaper "The Times" reported that Xi Jinping is planning to invite Trump and Putin to attend the gathering marking the 80th anniversary of Chinese victory against Japanese aggression, and a three-nation summit may be held. This matter has been rumored for a long time. If it does happen, it will be a major event in the world, and will be a big boost to the stock market. "

19-07-2025 (Sat) 9.30am

* 新加坡房地产股本周延续涨势,受以下利好消息的推动: - 城市发展(City Developments)周三宣布,与首席执行官在董事会中意见不合的董事杨致远(Philip Yeo)将辞职,城市发展股价周三上涨6%。摩根大通(JP Morgan)将城市发展的目标价从$4.85上调至$6.85,提出的利好因素包括,董事会之前的纠纷已解决、南滩(South Beach)项目的出售、借贷成本下降趋势、推迟产业项目的额外利润将被确认,以及潜在的特别股息和股票回购。城市发展公司周五(7月18日)收于$5.90,本周累计大涨8.7%。 - 据周一报道,凯德置地(CapitaLand Development)343单位的风之林(LyndenWoods)住宅项目,在开盘首日便售出超过94%的单位。LyndenWoods公寓的强劲销售提振了本地房地产股的势气。除了城市发展 (City Developments) 本周涨幅高达 8.7%以外,其他房地产股本周也有不错的表现。吉宝集团 (Keppel) 本周上涨 4.4% 至 $8.08,华业集团 (UOL Group) 本周上涨 2.4% 至 $6.81,凯德投资 (Capitaland Investment) 本周上涨 1.5% 至 $2.75。(值得注意的是,LyndenWoods 是由凯德置地(Capitaland Development)开发,而凯德集团这个部分的业务早在 2021 年已经私有化(privatised);凯德置地 与 目前主要经营购物中心和房地产信托基金的上市公司 凯德投资 (Capitaland Investments) 是两个不同的公司。尽管如此,凯德置地开发的 LyndenWoods 销售强劲, 证实了新加坡优质房地产强劲的需求,对所有房地产相关股来说是利好消息。) - 新加坡房地产股上扬与我们今年早些时候看好本地房地产股的观点一致。 * 美联储主席鲍威尔下周二(7月22日)的演讲将备受关注。美联储主席鲍威尔面临来自总统的降息压力。市场将关注任何有关美联储利率方向的言词。下次美联储会议将于7月29日至30日召开。 (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission. ) * Singapore property stocks extended gains this week after the release of several positive news on Singapore's real estate this week as follows: - City Developments jumped 6% on Wednesday following the announcement that dissenting director Philip Yeo in the boardroom feud with the CEO was stepping down. JP Morgan raised the target price of City Developments to $6.85 from $4.85 on positive factors such as the resolution of earlier board disputes, the sale of South Beach, declining borrowing costs, additional profit recognition from previously delayed projects, and potential special dividends and share buybacks. City Developments closed at $5.90 on Friday (18 July), having risen 8.7% for the week. - It was reported on Monday that CapitaLand Development’s LyndenWoods sold more than 94 per cent of its 343 units on its launch day. The strong sales performance of the condo launch of LyndenWoods boosted sentiments on property stocks this week. Other than the 8.7% weekly gain in City Developments, other property stocks had also performed well this week, with Keppel rising 4.4% this week to $8.08, UOL group rising 2.4% this week to $6.81, and Capitaland Investment rising 1.5% this week to $2.75. (It is good to note however that LyndenWoods is developed by Capitaland Development, which was privatized in 2021 as part of a strategic restructuring of CapitaLand Group; it is not the same as listed company Capitaland Investments, which deals mainly with the malls and real estate trust funds. Nevertheless, the strong sales launch of LyndenWoods by Capitaland Development is a testament of the strong demand for good property units in Singapore and is positive news for all property-related stocks) - The rally in Singapore property stocks is in line with our optimistic view on property stocks earlier this year.

18-07-2025 (Fri) 8.00am

新科工程拟出售合资公司SPTel ,可得一次过收益8000万元。 ST Engineering will be selling its joint venture SPTel, and the proposed sale will book a one-off gain of $80 million.

12-07-2025 (Sat) 9.15am

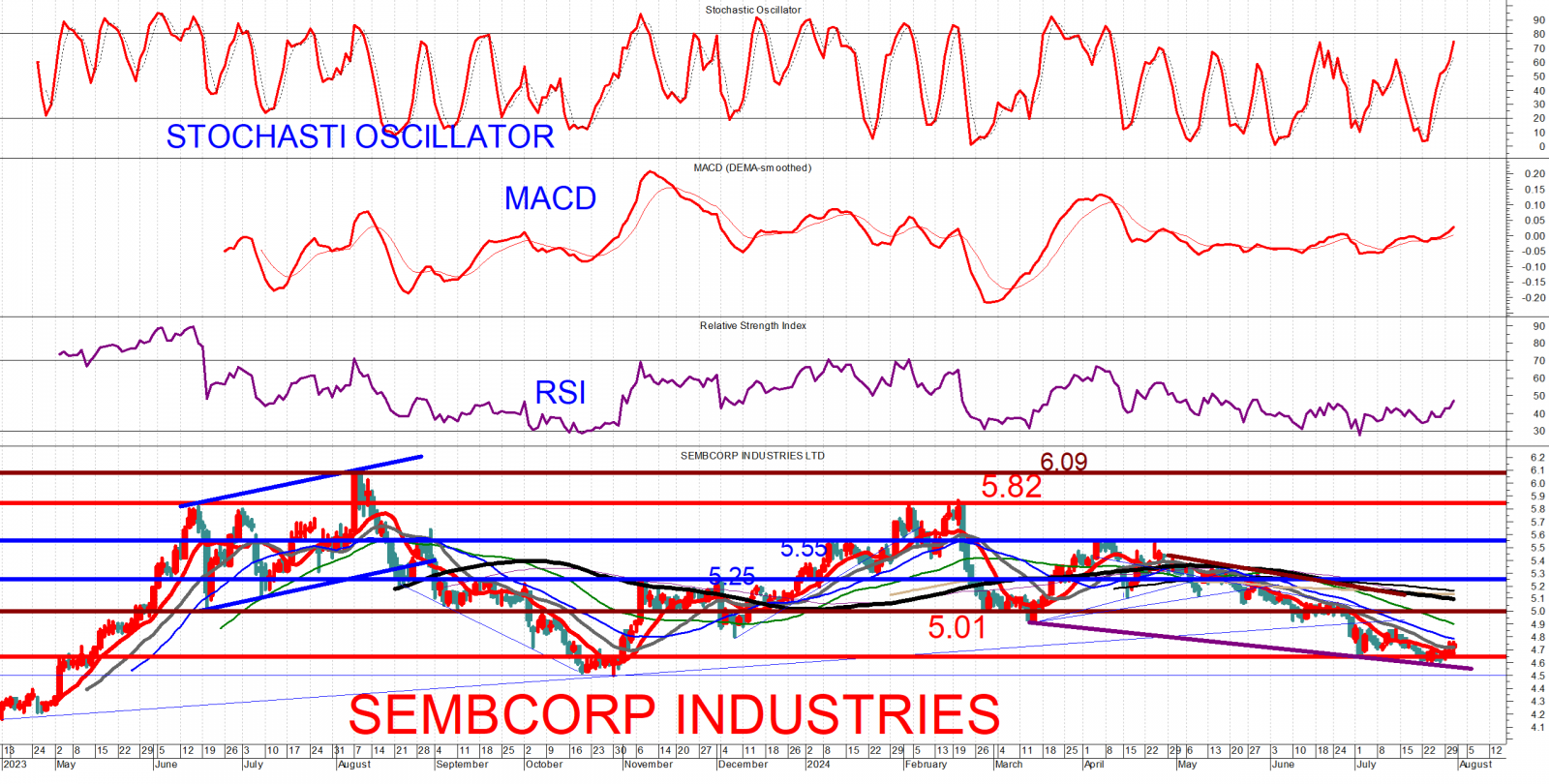

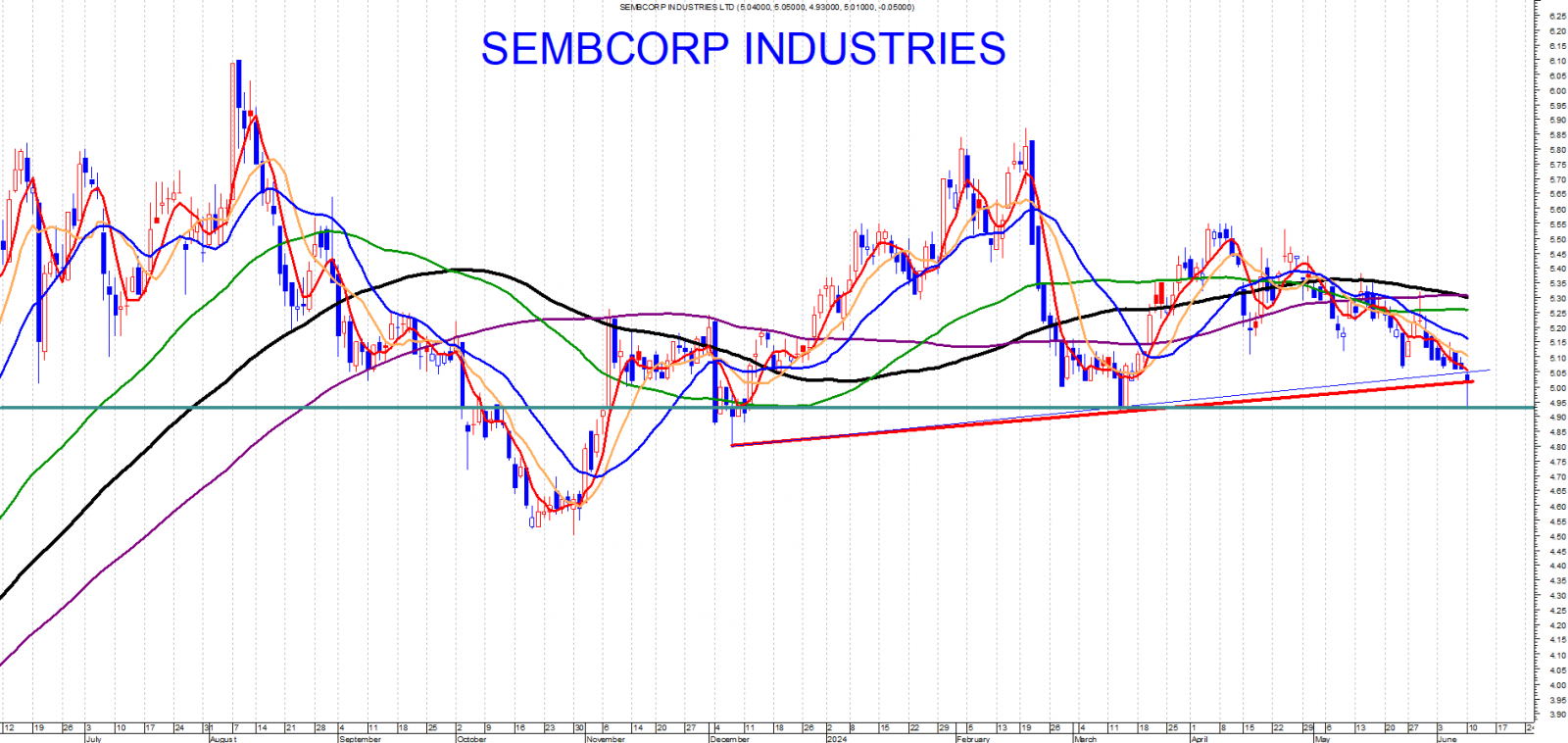

* 企业财报季将于下周拉开序幕。摩根大通(JP Morgan)、花旗集团(Citigroup)和富国银行(Wells Fargo)将于7月15日公布财报。美国银行(Bank of America)、摩根士丹利(Morgan Stanley)和高盛(Goldman Sachs)则于7月16日公布财报。网飞(Netflix)将于7月17日公布财报。 * 中信证券 Citic Securities (6030.HK) 周五上涨 $0.60 港元,涨幅 2.3%,收于 26.60 港元,创下 8 个月以来的收盘高点,盘中还一度触及 27.85 港元高点。中信证券的图表分析发布于 2025 年 1 月 20 日的 Ecomm 股市讯息,此后其股价已飙升逾 25%。以此股26.60 港元最后收盘价位来说,就已超越图表分析中的下限目标价。Ecomm Investment 此前看好中信证券、新加坡交易所和香港交易所等券商和证券交易所的股票,因为我们在今年很早时就看到了香港、中国和新加坡股市将会有很好的转机。 * 新交所(SGX) 的股价于 7 月 10 日(周四)盘中上扬至 $15.88高点,创下 17.5 年盘中高点,周五则收于 $15.46。就以$15.46收盘价来说 ,新交所自2月初以来已上涨约25%。(我们2025年2月7日和2025年3月1日的Ecomm股市讯息里曾提过看好新交所这支股。) * 除了政府支撑股市的措施以外,新加坡股市被视为拥有避险防御特性(safe haven asset),在目前的全球风险中得到青睐,有利于推动海指今年创下历史新高。 * 过去一年半里,陈奕利先生多次看好新加坡政联股, 并曾在 2024年1月25日、2024年2月3日、2024年2月15日、2024年3月26日、2024年3月27日、2024年8月31日、2024年9月20日、2025年2月18日、2025年3月17日、2025年3月21日、2025年3月25日 和 2025年4月14日等的Ecomm股市讯息中提到看好新加坡政联股。现在看到过去一年政联股的涨幅的确是非常可观。我们特别看好的一些政联股,如胜科工业(Sembcorp Ind)和新科工程(ST Engineering)都有超牛市的涨幅。胜科工业股价较一年前的$4.80已飙升54%,而新科工程股价较一年前的$4.38已大涨84%。 * 本周美国通胀数据将备受关注。尽管面临美国高额关税威胁,我们目前看到的通胀迄今仍受到抑制。但美联储对通胀可能将会上升的担忧仍然是降息的主要障碍。每次美联储会议前公布的各项通胀数据都将受到市场的关注。 ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission. ) * Corporate earnings season kicks off next week with U.S. banks JP Morgan, Citigroup and Wells Fargo reporting earnings on 15th July. Bank of America, Morgan Stanley, and Goldman Sachs will report earnings on 16th July. Netflix will report earnings on 17th July. * Citic Securities (6030.HK) rose 60 cents or 2.3% to close at an 8-month closing high of HK$26.60 on Friday, at one point even hitting an intraday high of HK$27.85. The charting analysis of Citic Securities was put up in the Ecomm market update on 20th Jan 2025, and its share price has since surged more than 25%. Its last done closing price at HK$26.60 has more than exceeded the lower target range mentioned in the charting analysis. We at Ecomm Investment had been sanguine on brokerage and stock exchange stocks such as Citic Securities, SGX and Hong Kong Exchange because we saw the tide turning for the Hong Kong, Chinese and Singapore market earlier this year. * SGX rose to a 17.5-year intraday high of $15.88 on Thursday, July 10th, and last closed at $15.46 on Friday. Even at $15.46, SGX has risen about 25% since the beginning of February. (SGX was mentioned in our Ecomm market updates on 7 Feb 2025 and 1 March 2025) * Other than the government support measures for the SGX market, the safe haven defensive traits of Singapore stocks amid global risks have also helped propelled the Straits Times Index to new historical highs this year. * Mr Tan Yi Li had been optimistic in Singapore government-linked stocks so many times in the past one-and-a-half year that one could almost lose count. His optimism in Singapore government-linked stocks was mentioned in the Ecomm market updates on 25 Jan 2024, 3 Feb 2024, 15 Feb 2024, 26 March 2024, 27 March 2024, 31 Aug 2024, 20 Sep 2024, 18 Feb 2025, 17 Mar 2025, 21 Mar 2025, 25 Mar 2025, and 14 Apr 2025 etc. As it turns out, the gains in government linked stocks have been very impressive in the past one year. Some of our favoured stocks like SembCorp Industries, and ST Engineering have soared like crazy. Sembcorp Industries surged 54% from its share price of $4.80 a year ago, while ST Engineering soared 84% from its share price of $4.38 a year ago. * U.S. inflation data is in focus this week. While inflation has so far been held in check despite of the threat of high U.S. tariffs, the Fed's concerns of rising inflation remains the main obstacle of interest rate cuts. The various inflation data leading to each Fed meeting will be closely watched by the market.

05-07-2025 (Sat) 9.00am

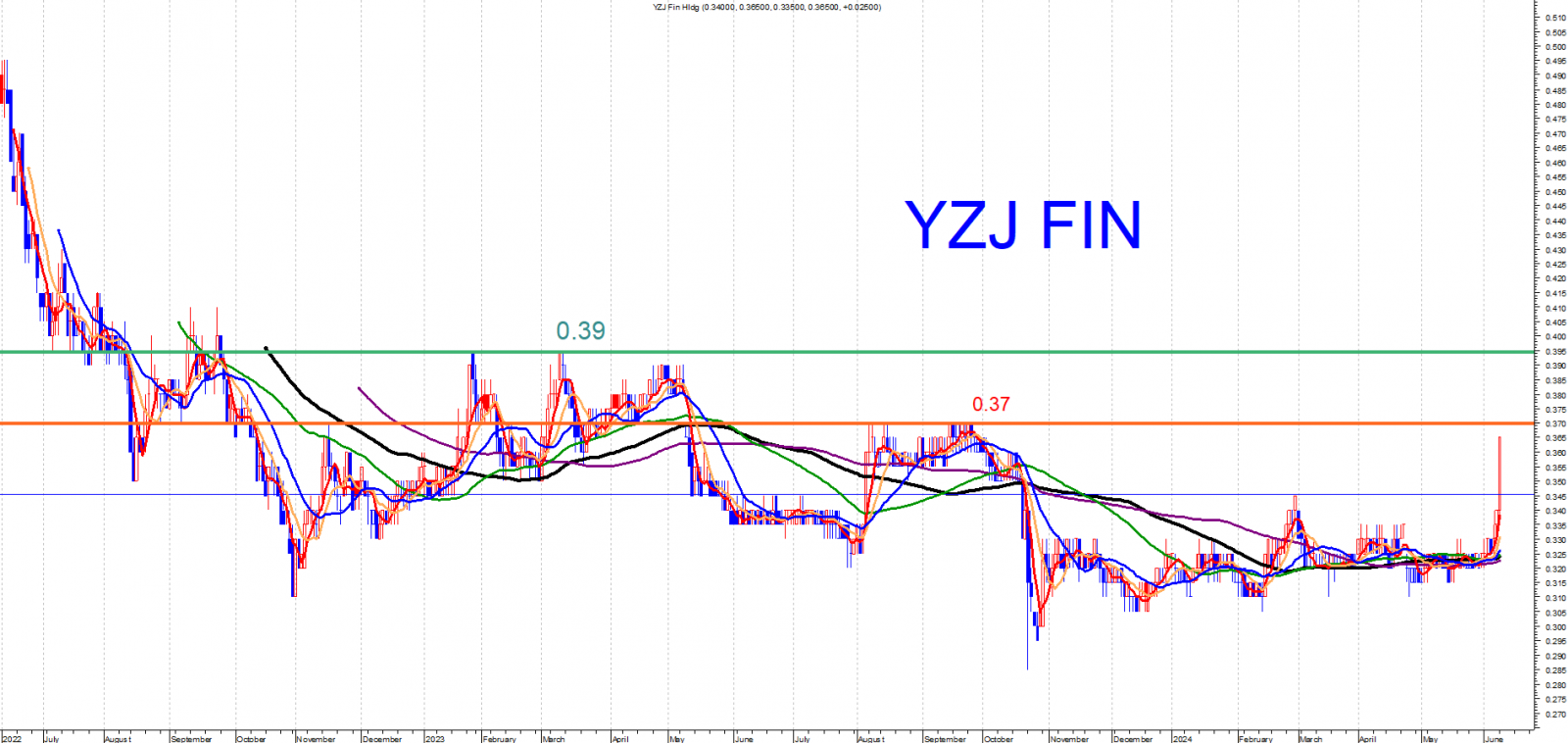

* 本地房地产股本周涨幅最大。我们看好的股票之一吉宝集团(Keppel)于7月3日创下17.5年来的收盘高点$7.70;香港置地(Hong Kong Land)于7月3日收盘于近6年高点$6.42;华业集团(UOL Group)于7月2日收盘于近2年高点$6.70;城市发展(City Development)于7月3日收盘于9个月高点$5.50;凯德置地商业信托(Capitaland Integrated Commercial Trust)于7月2日收盘于3年高点$2.23。在政府宣布提高卖方印花税后,本地房地产股周五回落。不过,即使把周五的跌幅算在内,房地产股本周仍录得很不错的涨幅,城市发展本周上涨4.9%,华业集团本周上涨6.4%,吉宝集团本周上涨2.6%,香港置地本周上扬8.6%。 Ecomm今年早些时候曾指出,由于价格合理并且面临着利率下降的趋势,可考虑买入房地产股作为长期投资,而现在开始看到的正是我们所预期的房地产股涨势。 * 扬子江金融(Yangzijiang Financial Holding)是Ecomm提到的另一只股票。该公司宣布分拆旗下海事投资业务,成立了子公司Yangzijiang Maritime Development, 并以介绍方式在新加坡交易所主板挂牌的计划已在推进中。宣布了此消息后,扬子江金融股价本周飙升23%,周五收于$0.895。 (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission. ) * Local property stocks saw the biggest gains this week. Keppel, one of our favourite stocks, hit a 17.5 year closing high of $7.70 on July 3, Hong Kong Land closed at a near 6 year high of $6.42 on July 3, UOL Group closed at a near 2 year high of $6.70 on July 2, City Development closed at a 9 month high of $5.50 on July 3, and Capitaland Integrated Commercial Trust closed at a 3 year high of $2.23 on July 2. Local property stocks retreated on Friday after the government announced the raise in seller's stamp duty. But, even if we take into account Friday's decline, property stocks still chalked up good gains this week, with UOL group rising 6.4% for the week, City Development rising 4.9%, Keppel rising 2.6%, and Hong Kong Land rising 8.6%. We at Ecomm have mentioned earlier this year that property stocks may be considered for long term investment due to the attractive valuations and a declining interest rate environment, and we are now seeing the gains rolling in. * Yangzijiang Financial, another stock that was mentioned here at Ecomm, surged 23% for the week to close at 89.5 cents on Friday, after the company announced the incorporation of Yangzijiang Maritime Development, a company it is proposing to spin off as a wholly owned subsidiary in Singapore, and to be listed separately on the main board of the Singapore stock exchange.

28-06-2025 (Sat) 9.00am

* 随着中美贸易谈判成功,半导体类股飙升。中芯国际(0981.HK)本周大涨13.5%(从6月20日收盘价39.50港元上涨至6月27日收盘价44.85港元)。《Business Times》周五(6月27日)报道,新加坡交易所上市的本地半导体相关股票,如AEM、UMS和Frencken,本周均取得了很不错的涨幅。AEM控股是半导体测试解决方案提供商,我们在5月14日股市讯息中也曾提到此股,AEM股价本周飙升至少23.6%(从6月20日收盘价$1.23上涨至6月27日收盘价$1.52)。我们之前曾屡次提到(包括在2025年6月9日和10日的股市讯息中有提过),半导体股可重见青天,并成为贸易谈判的受益者,而我们现在所看到的正是如此。 (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission. ) * Semiconductor stocks surged following the successful trade negotiations between the U.S. and China. SMIC (0981.HK) jumped 13.5% for the week (from the close of HK$39.50 on 20th June to the close of HK$44.85 on 27th June). Business Times reported on Friday (27th June) that local SGX-listed semiconductor-related stocks such as AEM, UMS and Frencken chalked up very good gains for this week. AEM holdings, a semiconductor test solutions provider which we had mentioned in our 14th May market update, surged at least 23.6% in its stock price this week (from the close of $1.23 on 20th June to the close of $1.52 on 27th June). We had mentioned repeatedly before (including in our market updates on 9th June and 10th June 2025) that semiconductor stocks could see the light of the day and benefit from the US-China trade negotiations, and this is what we are seeing now.

14-05-2025 (Wed) 7.45am

" 本地永科控股(AEM Holdings)截至3月底第一季净利同比大增43%至334万元,营收则同比减少9%至8600万元,净利率同比改善至3.9%。截至3月底,集团资产负债表依然稳健,集团每股净值产值保持于155.2分。永科控股成功进入新的人工智能(AI)和高性能计算(HPC)主要客户的大批量生产市场,抵消了集团营收的减少。集团营收多元化努力的进展顺利。从财报可看出永科控股正开始走出之前的困境,前景不错。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: " Local tech company AEM Holdings net profit for the first quarter ended March 31 increased 43% year-on-year to $3.34 million, while revenue decreased 9% year-on-year to $86 million. Net profit margin improved to 3.9% year-on-year. As at the end of March, the group's balance sheet remained strong, and the group's net asset value per share remained at 155.2 cents. AEM Holdings' successful entry into the mass production market of new artificial intelligence (AI) and high-performance computing (HPC) major customers offset the group's revenue decline. The group's revenue diversification efforts are progressing smoothly. From the financial report, it can be seen that AEM Holdings is beginning to emerge out of its previous difficulties and the company does have a good outlook. "

12-05-2025 (Mon) 8.15am

"经过两天的会谈,参与中美高层贸易谈判的美国高级官员宣称取得了“实质性进展”,并似乎确认两国已达成协议,这可能对全球经济产生巨大影响。美国财政部长斯科特·贝森特很高兴地报告,美中在贸易谈判中取得了实质性进展,谈判“富有成效”。 中美的谈判意外取得一些成果,周末的会谈标志着美中贸易关系可能正朝向解冻迈出了重要一步。果如是,这将是全世界之福,对全世界的经济和股市都会有很大的正面影响。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: "After two days of talks, senior US officials involved in high-level trade negotiations between China and the U.S. claimed "substantial progress" was made and seemed to confirm that the two countries have reached an agreement, which could have a huge impact on the global economy. US Treasury Secretary Scott Bessent was pleased to report that the U.S. and China have made substantial progress in trade negotiations. The US-China negotiations unexpectedly achieved some results, and the weekend talks indicated that US-China trade relations may be taking an important step towards de-escalation. If so, it will be a blessing for the whole world and will have a great positive impact on the world's economy and stock markets. "

10-05-2025 (Sat) 8.00am

* 中芯国际第一季度营收同比增长28%至22.4亿美元,股东净利润同比增长162%至1.88亿美元。然而,两项数据均低于预期。低于预期的业绩和不明朗的前景导致中芯国际股价周五收盘下跌4.8%至43.00港元。据路透社报道,美国客户占中芯国际第一季度营收的12.6%,因着关税的不确定性,导致下半年前景仍不明朗。中芯国际还预计本季度营收将下降,受新安装设备测试的拖累。 (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission. ) * SMIC revenue rose 28% year-on-year to US$2.24 billion in Q1, while its profit to shareholders in Q1 surged 162% year-on-year to US$188 million. However, both figures missed estimates. Lower than expected earnings results and a cloudy outlook led to SMIC share price closing down 4.8% to HK$43.00 on Friday. According to Reuters, U.S. clients accounted for 12.6% of its first-quarter revenue, and the outlook for the second half of the year is unclear due to the tariff situation. SMIC also projected a drop in revenue in the current quarter due to the testing of newly installed equipment.

24-04-2025 (Thu) 8.00am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "美国财政部长斯科特·贝森特周三声称现在有达成贸易“重大协议”的历史性机遇。他引用桥水基金创始人达利欧的概念,提议协同实现经济再平衡。 现今特朗普的团队好象只留下美国财长贝森特较理性的声音,对股市是正面的。 海指七连涨,恒生指数表现也不错,美股也开始动起来了。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: "U.S. Treasury Secretary Scott Bessent claimed on Wednesday that there is now a chance to reach a trade agreement. He cited the concept of Ray Dalio, founder of Bridgewater Fund, and proposed to jointly achieve economic rebalancing. It seems that the voice of US Treasury Secretary Bessent is the only rational voice left in Trump's team, which is positive for the stock market. The STI rose for seven consecutive days, and the Hang Seng Index performed well, and the US stock market also had begun to move higher. "

23-04-2025 (Wed) 7.30am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "海指已连续6天上涨,表现不错。中国和香港的股市的表现也很好。 我个人也一直认为中美必会进行谈判,因为谈判是双赢,脱钩是双输。如今已有迹象显示中美有可能在接触中,这是全世界的福音。4月21日重提4月14日的报告,在关税的重压下,股市极度惊慌时,我还敢提出相反的看法,是相当够胆的。4月14日的报告现在还值得参考。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: "The STI has risen for 6 consecutive days, which is indeed a great performance. The stock markets of China and Hong Kong have also performed well. I personally have always believed that China and the United States will proceed to negotiate, because negotiation is win-win, while decoupling is a lose-lose situation. Now there are signs that China and the United States may be in contact, which is good news for the whole world. I mentioned it in the market report on April 14, and then again on April 21. Under the pressure of tariffs, when the stock market was in extreme panic, I was daring enough to put forward the opposite view. The market report on April 14 is still worth referring to now. "

21-04-2025 (Mon) 7.45am

18-04-2025 (Fri) 8.00am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "辉达首席执行官黄仁勋时隔3月再访问北京,和中共政治局委员、国务院副总理何立峰会面。黄仁勋表示,看好中国经济前景,愿继续深耕中国市场,为推动美中经贸合作发挥积极作用。黄仁勋刚不久前才去见特朗普,就匆匆忙忙赶往不久前才访问的中国,信使传达消息的可能性很大。这是我个人的猜测,需要看事后的发展。 关税将使中美经济受损,其实两国都有意愿进行协商,但都放不下脸来。中国突然撤换贸易谈判代表,似乎有点意思要准备和美国协谈,试想不要和谈,又何必撤换贸易谈判代表。我个人认为只要不损及中国国家尊严,给足中国面子,中美的关税谈判是可以实现的。如果两国能进行协商,股市会大涨。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: "Nvidia CEO Jensen Huang visited Beijing again after three months and met with He Lifeng, member of the Political Bureau of the Communist Party of China Central Committee and Vice Premier of the State Council of China. Jensen Huang said that he was optimistic about China's economic prospects, is willing to continue to deepen Nvidia's presence in the Chinese market, and to play an active role in promoting US-China economic and trade cooperation. Jensen Huang had just met with Trump not long ago, and he hurried to go to China afterwards, which he had just visited not long ago. We shall have to see the subsequent developments that unfold. Tariffs will damage the economies of China and the United States. In fact, both countries are willing to negotiate, but neither of them is willing to back down. China suddenly replaced the trade negotiator, which seemed to indicate that it is preparing to negotiate with the United States. After all, why replace the trade negotiator if there be no willingness for trade negotiations? I personally think that as long as the U.S. does not damage China's national dignity and gives face to China, the tariff negotiations between China and the United States can still be achieved. If the two countries were to negotiate, the stock market will rally sharply. "

14-04-2025 (Mon) 7.30am

新加坡的股票也是跌得很重,好多股票已触及支持线,如能守得住,应会有一番作为。这些股票包括OCBC、凯德投资(CapitaLand Investment)、新航空(SIA)、SATS、SIA ENGINEERING等等。"

10-04-2025 (Thu) 8.00am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "昨天我也写过“特朗普要做的事,一定会去做,所以关税不会停下来。关税仍将困扰着股市。不过,他的另一个特性先强硬,后放软对股市就有转机”。现在正是特朗普放软的时候,我个人认为4月股市的涨潮可能即将开始。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: "Yesterday I also wrote that "Trump will do whatever he wants to do. Hence, the tariffs will not cease, and will continue to plague the stock market. However, his other characteristic of being tough first and then softening later, could possibly lead to a turnaround in the stock market." Now is the time that Trump has softened his tariff stance, and I personally think the stock market rally in April may be about to begin."

07-04-2025 (Mon) 8.00am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "特朗普对全球180多个国家征收的超大关税,上调幅度大大超过预期,是毁灭性的。 特朗普的关税上调幅度大大超过预期,美国的物价可能会比几周前预测的更高、经济增长可能会比几周前预测的更疲弱。 上周五鲍威尔的讲话中隐约透露出美联储对如何应对关税后果的谨慎态度。由于近年来通胀率一直居高不下,而且这轮关税上调的幅度很大,美联储这次可能会等到经济疲弱迹象更加明显时才会降息。 1930年美国由总统赫伯特·胡佛(Herbert Hoover)签署生效的《1930年斯姆特-霍利关税法》(Smoot-Hawley Tariff Act),将美国进口关税提高到历史高位,对超过20,000种进口商品加征关税,平均关税税率升至约50%,引发其他国家报复性关税,全球贸易量在1929—1934年间缩水约60%,引发了大萧条。特朗普对全球185个国家征收的超大关税,和1930年的关税,有过之而不及,不遑多让。全世界的人都很难想象还会发生这样的事情。 第一太平戴维斯(Savills)发布的财富动态指数显示,新加坡凭借企业税收政策、友好商业环境、外国直接投资额以及经济和知识基础等优势,超越首尔、纽约、伦敦和阿布扎比,成为企业搬迁首选目的地。而个人迁居热门地,新加坡则排名第三。 很多国家已对美关税实施反制措施,尤其是中国的反制裁,在现有税率基础上,一次性再对所有美国输华商品加征34%关税。简直是几近于和美国脱钩,针锋相对,毫不退让,贸易大战开打,全球经济股市遭殃。本地也不能幸免,上周五股市也顶不住大跌。 另一方面,新加坡前外交部长杨荣文声称他注意到,从特朗普刻意回避台湾问题,以及他谈起中国国家主席习近平时的语气来看,特朗普其实希望中美关系能朝某种稳定方向发展。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: "Trump's super-large tariffs on more than 180 countries around the world were much higher than expected and were devastating. With Trump's new tariffs coming in much higher than expected, U.S. prices are now predicted to be higher than a few weeks ago, and economic growth is now projected to be weaker than a few weeks ago. Powell's speech on Friday hinted at the Fed's caution in dealing with the consequences of tariffs. With inflation high in recent years and with such high tariffs coming up, the Fed may wait until signs of economic weakness are more apparent before cutting rates this time. The Smoot-Hawley Tariff Act, signed into law by President Herbert Hoover in 1930, raised US import tariffs to historic highs. The Smoot-Hawley Tariff Act imposed tariffs on more than 20,000 imported goods, raising the average tariff rate to about 50%, and triggering retaliatory tariffs from other countries. Global trade volume shrank by about 60% between 1929 and 1934, triggering the Great Depression. Trump's super-high tariffs on 185 countries around the world are even worse than the tariffs in 1930. It is hard for people all over the world to imagine that something like this would happen. The Wealth Dynamics Index released by Savills shows that Singapore has surpassed Seoul, New York, London and Abu Dhabi to take the top spot for the most preferred destination for corporate relocation, due to its corporate tax policies, friendly business environment, high volumes of foreign direct investment, and economic and knowledge bases. Singapore ranks third as a preferred destination for individual relocation. Many countries have implemented countermeasures against US tariffs, especially China, which will impose an additional 34% tariff on all US goods exported to China at the existing tariff rate, almost decoupling from economy of the United States. The trade war has started, and the global economy and stock market have taken a hit. The local market is not immune, and had fallen sharply last Friday. On the other hand, Singapore's former Foreign Minister George Yeo said that from his observations of Trump's deliberate avoidance of the Taiwan issue and from Trump's tone when talking about Chinese President Xi Jinping, it seems that Trump actually hopes that Sino-US relations would move towards stabilisation.

04-04-2025 (Fri) 8.30am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "特朗普关税战震惊世界,跨国企业惨遭抛售。美国总统特朗普宣布对几乎所有国家额外征收10%到50%的“对等关税”,此举可能引发全球贸易战,重创本已疲软的美国经济。美股周四大跌。 加征关税最严重的国家在亚洲,对中国进口货品关税,将会在特朗普上台后已加征20%税率的情况下,再加征34%,共加征54%。柬埔寨、越南和缅甸的税率分别达49%,46%和44%。台积电已答应在美国出资千亿美元建厂,台湾也不能幸免,被征32%关税。 美国商务部长霍华德·卢特尼克称,特朗普政府今天将与贸易伙伴讨论关税问题。我们要看看这漫天开价的关税将如何削减?这将会影响股市的走势。特朗普虽然在最近曾说,不在乎股市下跌,但只要回顾特朗普1.0时,他是多么的在乎股市的走势,所以他应该还是会关心股市。 4月5日起,美国将对几乎所有国家额外征收10%基准关税,其他更高对等关税则将于4月9日生效。关税税率远高于许多国家的预期,也远远超出了人们最坏的预测。未来几天还可能将向对美国征收更高税率的国家征收更高的关税。这种匪夷所思和毫无理性的毁灭性做法,虽然是一种高超的谈判方法,但也可能严重伤害到美国和全世界的经济,美股爆跌是警钟。 美国前财长萨默斯表示,特朗普政府计算对等关税时并没有使用关税数据。他表示,该关税对经济学就如同神创论之于生物学,占星学之于天文学。即使对于那些保护主义的重商主义经济学信奉者来说,特朗普的关税政策也几乎毫无道理。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: "Trump's tariff war shocked the world, and multinational companies were sold off. The 10%-50% tariffs imposed by President Trump may trigger a global trade war, and hit the already weak US economy hard. US stocks fell sharply on Thursday. The countries with the most severe tariffs are in Asia. An additional 34% tariffs on Chinese imports will be imposed, on top of the 20% tariff already in place, for a total of 54% additional tariffs. The additional tariffs imposed on imports from Cambodia, Vietnam and Myanmar are 49%, 46% and 44% respectively. TSMC has agreed to invest $100 billion in the United States to build a factory, and yet Taiwan is not immune to the tariffs, and is subjected to an additional 32% tariffs. Howard Lutnick, the US Secretary of Commerce, said that the Trump administration will discuss tariffs with trading partners today. Will these sky-high tariffs be reduced? We shall have to wait and see. All these tariffs will affect the trend of the stock market. Trump recently said that he does not care about the stock market falling, but if we look back at Trump 1.0, it did show how much he cared about the stock market trend. The additional 10% universal tariff will be effective on 5 April, while the higher reciprocal tariffs will begin on 9 April. The tariff rate is much higher than many countries expected, and far exceeds the worst predictions. In the coming days, higher tariffs may also be imposed on the United States by other countries in retaliation. Although this could be a superb negotiating tactic, this bizarre and irrational destructive approach may also seriously harm the US and global economies. The collapse of US stocks is already a warning alarm. Former US Treasury Secretary Summers said that the Trump administration did not use tariff data when calculating reciprocal tariffs. He said that the tariff is to economics what creationism is to biology, and astrology is to astronomy. Even for those who are believers in protectionist economics, Trump's tariff policy makes little sense. "

03-04-2025 (Thu) 8.30am

*最新消息* 特朗普宣布的关税措施比预期更糟糕,美国将对所有进口产品征收 10% 的基准关税,将对中国进口产品征收额外 34% 的征收关税 (这是之前已经征收20%加征关税之上),也将对欧盟征收 20% 的加征关税。 消息公布后,道指期货暴跌 1000 点。自 2 月以来,美国股市市值已损失掉近 5 万亿美元。 美国贸易伙伴预计将采取各自的反制措施。经济学家警告称,关税可能会拖累全球经济,增加经济衰退风险,并使美国家庭的生活成本增加数千美元。 (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) *Breaking news* Trump announced tariffs that were worse than expected, with a 10 per cent baseline tariff on all imports to the US, a 34 per cent tariff on Chinese imports on top of the 20 per cent levy already imposed on China, and a 20 per cent tariff on the European Union. The Dow futures plunged 1000 points following the announcement. US stocks have lost nearly US$5 trillion of value since February. The trading partners of the U.S. are expected to respond with countermeasures of their own. Economists have warned that tariffs could slow the global economy, increase the risk of recession, and raise the living costs for the average US family by thousands of US dollars.

31-03-2025 (Mon) 8.30am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "SIA ENGINEERING是政联股票,经过大跌后,已触及很强的支持线,2.18如能守得住,就会有不错的表现。

扬子江金融控股去年下半年净利同比飙升402%,总收入增加16%至1亿6490万元。它的全年净利增加51%至3亿零460万元,年终股息每股3.45分。我在去年12月底的讲座上曾强调可注意这只股票,当时我个人认为这只股票值得一块钱。当时的股价是4毛左右。"

(所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: "SIA ENGINEERING is a government-linked stock. After a sharp drop, it has touched a strong support line. If it can hold 2.18, it will likely do well.

Yangzijiang Financial Holdings' net profit soared 402% year-on-year in the second half of last year, and total revenue increased 16% to S$164.9 million. Its full-year net profit rose 51% to S$304.6 million, and the year-end dividend was 3.45 cents per share. In my seminar at the end of December last year, I emphasized this stock was worth looking into. At that time, I personally mentioned that this stock was worth one dollar. Its stock price was around 40 cents at the time."

22-03-2025 (Sat) 7.15am

* 扬子江金融控股(YZJ Fin Hldg)周五大涨 6.6% 或 4.5分,至 $0.725 。扬子江金融控股(股票代码:YF8)今年大涨,虽是个迟来的春天,但表现非常亮丽,是个漂亮的春天。 此股自 2024 年 6 月以来已上涨超过 100%,符合我们对扬子江金融值得长期投资的预测。(请参阅 2024年 6月 11日 的Ecomm 讯息) * 继长江和记实业(CK Hutchison Holdings)令人失望的盈利报告以及股市近期迅速上涨以后,香港股市周五继续回调。恒生指数下跌 2.2%。上证综合指数下跌 1.3%。 * 腾讯本周公布好于预期的盈利,净利同比增长 90%,受 AI 云收入的提振。腾讯(0700.hk)股价较一年前上涨超过 75%。 腾讯和扬子江金融 曾都是Ecomm Investment 视为值得长期投资的股票,那些买入并持有至今的投资者均都成为大赢家。 * 小米本周公布强劲业绩,调整后净利增长 41%。小米 (1810.HK) 股价较去年同期上涨逾 270%,其电动汽车业务获取漂亮的回报。 * 港股大涨符合我们早在去年屡次看好香港和中国股市的乐观预测。 (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission. ) * Yangzijiang Financial (YZJ Fin Hldg) jumped 6.6% or 4.5 cents to $0.725 on Friday. The late surge in Yangzijiang Financial (stock code: YF8) this year has seen its share price jump more than 100% since June 2024, in line with our expectations that Yangzijiang Financial is a worthy long-term investment. (Please refer to the Ecomm update on 11 June 2024) * Tencent reported better-than-expected earnings this week with a 90% jump in net profits year-on-year, boosted by AI cloud revenue. The share price of Tencent (0700.hk) has surged more than 75% from a year ago. Both Tencent and Yangzijiang Financial were mentioned as worthy considerations for long-term investments here at Ecomm Investment, and those who bought these stocks and held till now would have been big winners. * Xiaomi reported strong earnings of a 41% jump in its adjusted net profits this week. The stock price of Xiaomi (1810.HK) has jumped more than 270% from year ago as its EV venture paid off. * The surge in Hong Kong stocks is in line with our repeated optimistic forecast of Hong Kong and Chinese stocks as early as last year.

18-03-2025 (Tue) 8.15am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "据传路透社報导中国最大的芯片制造商中芯国际高管表示,其主要成熟芯片市场在2025年下半年可能出现供过于求的情况,这削弱了人们对疫情后经济复苏的乐观情绪。中芯国际受到负面消息的影响,压力增加。 至于中芯国际涉及香港证监会金至尊集团资金挪用案,3月14日披露,仅范仁达涉及金至尊集团,不涉及中芯国际任何其他董事或高级管理人员。截至3月16日,原讼法庭尚未对香港证监会针对范仁达提起的任何诉讼作出具有约束力的裁决。公司董事会(范达仁除外)认为范达仁仍适合担任公司独立非执行董事,原因为是监管通讯所载的调查结果及结论并无说明范达仁不适合担任香港上市公司的董事。 另一方面,3月17日估值之家推荐给大家的股票是中芯国际,认为中芯国际是中国大陆技术最先进、规模最大、配套服务最完善、跨国经营的专业晶圆代工企业.中芯国际2024年三季度,中芯国际位居全球晶圆代工行业第三,在中国大陆企业中排名第一。 不管怎样,现在买卖中芯国际,需要格外小心。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: "Reuters reported that executives of China's largest chipmaker SMIC said that its main mature chip market may be in excess of supply in the second half of 2025, which weakened people's optimism about the post-epidemic economic recovery. With regard to the investigation of the Hong Kong Stock Exchange into SMIC's involvement in the 3DG fund misappropriation case, it was disclosed on March 14 that only independent non-executive director Fan Ren Da of SMIC was implicated with 3DG, and not any other directors or senior management of SMIC. As of March 16, the Court of First Instance has not yet made a binding ruling on any lawsuit filed by the Hong Kong Securities and Futures Commission against Fan Ren Da. The company's board of directors (except Fan Ren Da) has determined that Fan Ren Da is still suitable to serve as the company's independent non-executive director because the investigation results and conclusions contained in the regulatory communication do not indicate that Fan Daren is not suitable to serve as a director of a Hong Kong listed company. On the other hand, one of the Chinese research analyst 估值之家 on March 17 gave a positive recommendation on SMIC, which is considered to be the largest and most technologically multinational professional wafer foundry company in mainland China. In the third quarter of 2024, SMIC ranked third in the global wafer foundry industry and ranked first among mainland Chinese companies. In any case, you ought to be extra careful now when buying and selling SMIC."

14-03-2025 (Fri) 8.15am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "香港交易所正研究降低部分高价股的最低入场门槛,以刺激市场交易。政策制定仍在进行中,时间表和实施范围尚未明确。 数据显示,3月12日南向香港资金净买入262.12亿港元,刷新了南向资金净买入金额的单日第三高纪录。今年以来,南向资金流入港股的速度加快,截至目前,年内净流入金额达到3657.20亿港元,同比大增超4倍。香港股市还值得注意。 DeepSeek横空出世,中国科技股大受欢迎,逆市走强,成为全球资本市场的焦点。恒生科技指数年内累计涨幅30.82%,排名恒生重点指数涨幅榜的第一位,俨然已进入牛市周期。在科技股的带动下,恒生指数年内累计涨幅达到17.65%,在同期全球重要指数中遥遥领先。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: "The Hong Kong Stock Exchange is studying to lower the threshold for investors to buy some of the high-priced stocks to stimulate market transactions. Policy formulation is still in progress, and the timetable and implementation scope have yet to be clarified. Data showed that net inflow of southbound Hong Kong funds on March 12 reached HK$26.212 billion, setting a new record for the third highest single-day net inflow since the launch of the Hong Kong Stock Connect. Since the beginning of this year, the southbound funds flowing into Hong Kong stocks has accelerated. So far, the net inflow amount has reached HK$365.72 billion this year, a year-on-year increase of more than 4 times. The Hong Kong stock market is worth looking into. With the sudden emergence of DeepSeek, Chinese technology stocks had become very popular, rising contrary against the market trend and becoming the focus of the global capital market. The Hang Seng Technology Index has increased 30.82% this year, ranking first in the Hang Seng Key Index Growth List, and has clearly entered a bull market cycle. Driven by technology stocks, the Hang Seng Index has risen 17.65% this year, far ahead of other major global indices in the same period."

01-03-2025 (Sat) 11.00am

* 继北京采取了提振股市的措施后,香港证券交易所报告了创历史新高的2024年利润,结束了两年的低迷业绩。香港交易所周四公布2024全年股东应占溢利润为 131 亿港元,超越了2021 年所创下的 125 亿港元纪录。香港火热股市在过去 2 个月内提振了港交所 HKEX (0388.HK) 的股价。 * 继财政部第二部长徐芳达上周五宣布了 50 亿新元的股票市场发展计划后,新加坡交易所市场本周交易量明显增加,周五交易量甚至突破 20 亿股。 (我们早在去年 9 月 17 日的股市讯息中就有提过,财政部第二部长徐芳达透露新加坡正在探索一系列振兴股市的新想法,SGX 股价也自此一路飙升。)本地 SGX 市场整体交易量如果持续维持在高位,将有利于 SGX 股价。SGX目前股价为 $13.45。 (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission. ) * Hong Kong stock exchange operator reported record profits in 2024 after Beijing's moves to boost the markets, putting an end to a 2 year slump. Hong Kong Exchanges and Clearing posted full-year profit attributable to shareholders of HK$13.1bn on Thursday, topping the previous record of HK$12.5bn set in 2021. The Hong Kong stock market boom has boosted the stock price of HKEX (0388.HK) in the past 2 months. * Following the announcement of the S$5 billion Equity Market Development Programme by Second Minister for Finance Chee Hong Tat on Friday last week, the trading volume in SGX market has seen a marked increase this week, with the trading volume even topping 2 billion shares on Friday. (We have mentioned as early as in our 17-Sep-2024 update last year that Second Minister for Finance Chee Hong Tat had revealed that Singapore was exploring a series of new ideas to revitalize the stock market, and the stock price of SGX has soared since then.) If there be a sustained increase in the overall trading volume of the local SGX market, it would benefit the stock price of SGX, which is currently trading at $13.45.

26-02-2025 (Wed) 8.00am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "阿里巴巴公布下一代人工智能(AI)推理模型QwQ-Max,将与行业顶尖的OpenAI的o1及深度求索(DeepSeek)的R1模型竞争。 胡润研究院发布“2024胡润中国500强”,台积电、腾讯、字节跳动位列前三,华为重返前十。 DeepSeek已使美国的AI公司重创,而支撑美股不断上涨的动力正是美国的AI公司,如今优势尽失,而且中国新的科技公司又不断出现,成绩斐然,美国的领先优势已渐渐消失,我早些时候已提到要密切注意美国股市,尤其是3月股市的走势,提防美股可能出现的大调整。 巴菲特的公司目前拥有3342亿美元大量的现金,应会伺机在股市大跌的时候进场。 (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li:

Alibaba announced the next-generation artificial intelligence (AI) reasoning model QwQ-Max, which will compete with the industry-leading OpenAI's o1 and DeepSeek's R1 models.

Hurun Research Institute released the "2024 Hurun China Top 500", with TSMC, Tencent, and ByteDance ranking in the top three, and Huawei returning to the top ten. DeepSeek has hit American AI companies hard, and it is the American AI companies that are supporting the continued rise in US stocks. Now that new Chinese technology companies continue to emerge with remarkable achievements, the leading edge of the US has gradually disappeared. I mentioned earlier that we should pay close attention to the US stock market, especially its trend in March, and beware of the possible major downside adjustments in the US stock market. Buffett's company currently has a large cash holdings of US$334.2 billion, and is likely to be awaiting for an opportunity to enter into the market should there be a sharp retreat.

25-02-2025 (Tue) 7.30am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "扬子江金融(Yangzijiang Financial Holding)2024下半年净利飚升至1.973亿元,大涨402%。总收入增加16%至1亿6490万元。它的全年净利增加51%至3亿零460万元。建议派发每股3.45分的年终股息,高于一年前的每股2.20分。股息十分吸引人。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: "Net profit of Yangzijiang Financial Holding soared to 197.3 million yuan in the second half of 2024, a surge of 402%. Total revenue rose 16% to 164.9 million yuan. Its full-year net profit rose 51% to 304.6 million yuan. It is recommending to distribute a year-end dividend of 3.45 cents per share, higher than the 2.20 cents per share a year ago. The dividend is very attractive.

15-02-2025 (Sat) 8.30am

* 扬子江金融 (YZJ Fin) 收涨 1.9%,至 53 分。这只股在我们 2024年6月11日的技术图表分析中有再次被提及。近两年来,该股价大致上都在 40 分以下交易,而今年终于冒出头来,出现上升的趋向。 * 恒生指数周五飙升 3.69%, 或 805.96 点,科技股继续领涨。腾讯上涨 7.42%,至 474.80 港元。我们在 2025年2月6日早上9点讯息中提到的比亚迪再飙升 7.43%,至 364.20 港元。 * 阿里巴巴周五上涨 6.34%,至 124.10 港元。我们在 2025年1月20日的技术图表分析中有再次推荐阿里巴巴,当时其交易价为 85.38 港元;此后,其股价如烈马奔腾,从那时到目前为止,已飙升了超过 45% 。 所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission. ) * Yangzijiang Finance (YZJ Fin) closed up 1.9% to 53 cents. This stock was mentioned again in our technical chart analysis on 11 June 2024. It had been largely trading below 40 cents for almost 2 years, and finally had an impressive run this year. * The Hang Seng Index surged 3.69% or 805.96 points as tech stocks continued to lead gains. Tencent jumped 7.42% to HK$ 474.80. BYD, which was mentioned in our 6 Feb 2025 9.00am update, soared another 7.43% to HK$364.20. * Alibaba rose 6.34% to HK$124.10. The technical chart analysis of Alibaba was done in our 20-Jan-2025 market update when its stock price was trading at HK$85.38; Alibaba's stock price had since galloped 45% to the current price like a raging stallion.

11-02-2025 (Tue) 8.00am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "星展集团第四季和全年业绩创新高,终期股息也增加。集团董事会提议第四季派发每股60分的终期股息,比之前的派息增加6分,这使得集团全年派息每股2.22元,较一年前增加27%。 星展集团计划推出季度资本回报股息,降低过剩的资本,2025财年第一季为每股15分。这个消息带动星展集团星期一股价再创新高,突破46元。 在银行股的带动下,海指上涨。星展集团股价闭市报45.38元,收涨1.57%。大华银行和华侨银行闭市报37.77元和17.39元,收涨1.04%和0.35%。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: "DBS Group's fourth quarter and full-year results hit new highs, and the final dividend also increased. The group's board of directors proposed a final dividend of 60 cents per share in the fourth quarter, an increase of 6 cents from the previous dividend, which makes the group's full-year dividend $2.22 per share, an increase of 27% from a year ago. DBS Group plans to introduce a quarterly capital return dividend of 15 cents per share per quarter to be paid out over 2025. The news drove DBS Group's share price to a new high on Monday, breaking above $46 at one point.

07-02-2025 (Fri) 8.00am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "中芯国际(0981.hk)周三再大涨3.20港币或7.16%,报47.90元。其涨势相当惊人。 比亚迪(BYD 1211.hk)大涨32.60港币,或11.51%,涨势更威猛。 新加坡交易所(SGX)表现超乎分析师的预测,截至去年底2025财年上半年的净利达3亿4000万元,比上个财年同期增加20.7%。花旗研究(Citi Research)和摩根士丹利(Morgan Stanley)分析师都给予新交所买入评级。 新科工程去年第四季获取得43亿元新合同。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: "SMIC (0981.hk) rose another HK$3.20 or 7.16% to HK$47.90 on Wednesday, and its meteoric rise is quite amazing. BYD (1211.hk) rose HK$32.60, or 11.51%, with a surge that is even more impressive. The Singapore Exchange (SGX) performed better than analysts expected, with a net profit of $340 million for the first half ended December, an increase of 20.7% over the previous corresponding period a year ago. Analysts from Citi Research and Morgan Stanley both gave SGX a buy rating. ST Engineering secured new contracts worth $4.3 billion in the fourth quarter of last year. "

06-02-2025 (Thu) 9.00am

Following the success of Chinese-developed DeepSeek, TikTok and BYD, China is looking to develop self-sufficiency in the manufacturing of its advanced semiconductor chips in the light of U.S. sanctions and restrictions.

Singapore stocks tend to be relatively less volatile compared to that of other markets, and do have its global appeal as safe haven assets in times of uncertainties.

27-01-2025 (Mon) 7.30am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "CAPITALANDINVEST(凯德投资 )从3.20一路下跌至2.42。2.42是长期较强的支持线,有可能止跌回升,上试2.69。支持:2.42。现价:2.44。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: "CAPITALANDINVEST (CapitaLand Investment) fell from 3.20 to 2.42. 2.42 is a long-term strong support line, and it may be possible for this stock to reverse the slide, and test the upside at 2.69. Support: 2.42. Current price: 2.44."

20-01-2025 (Mon) 8.00am

China has launched an investigation into allegations that the US dumps lower-end mature chips and unfairly subsidizes its own chipmakers. Such investigations will benefit SMIC, because its strengths are in mature chips, and fewer competitors will lead to higher profits for SMIC.

16-01-2025 (Thu) 8.00am

06-01-2025 (Mon) 6.30am

03-01-2025 (Fri) 8.00am

31-12-2024 (Tue) 7.30am

04-12-2024 (Wed) 7.30am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "新加坡海指表现强劲,麦格理集团(Macquarie)预期,2025年海指或有望上探4000点。ECOMM网站以前提过的个别股可能都可以开始注意,开始买进,以迎接1月可能出现的涨潮。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: Singapore's STI performed strongly, and Macquarie Group is forecasting that the STI may reach 4,000 points in 2025. We may start to look out for the individual stocks mentioned before in the ECOMM website and start buying in anticipation of a possible surge in January. "

02-12-2024 (Mon) 9.15am

新闻报道的黄有志(Ng Yu Zhi)诈骗案给人留下了深刻印象。这不仅是因为947名投资者被骗走了近15亿元的巨额资金,而是因为受害者包括知名专业人士,如Vickers Venture Partners创始人 Finian Tan,此人在2000年看好搜索巨头百度的潜力而闻名,还有淡马锡国际总法律顾问 Pek Siok Lan 和 前律师协会会长 Thio Shen Yi。《海峡时报》报道,Mr Finian Tan 被骗1920万美元(2580万新元),Ms Pek 被骗550万元,Mr Thio 则被骗50多万元。另一名受害者是基金管理公司Envysion Wealth Management(EWM)前首席执行官Veronica Shim,她自己损失了955,115.08元,而她之前管理的基金管理公司EWM损失了 4730万元。Ms Shim 在法庭上作证说,她之所以相信 黄有志 先生的话,是因为 黄有志先生是新加坡人,在新加坡长大,受过良好的教育,他的公司获得了新加坡金融管理局 (MAS) 的牌照(license),而且她也被伪造的文件蒙骗了。黄有志 先生声称,他的公司可以以折扣价从澳大利亚的一家矿山购买镍(Nickel),然后以可观的利润出售,但实际上,他的公司并没有买卖任何镍,早期投资者得取的利润是来自后者投资者投入的资金,是个庞氏骗局(Ponzi scheme)。在这个案例中,著名的专业人士和基金经理都被骗了。Ms Shim 在法庭上给了大家一个宝贵的提醒,那就是无论你是不是专业人士,这种事情都可能发生在任何人身上。 (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission. ) The cheating case of Ng Yu Zhi reported in the news left a deep impression. It is not just because 947 investors were duped of a mega amount of almost $1.5 billion, but also because the victims included prominent professionals such as Vickers Venture Partners founder Finian Tan, known for spotting the potential in search giant Baidu back in 2000, when it was just a small Chinese start-up, Temasek International general counsel Pek Siok Lan, and former Law Society president Thio Shen Yi. The Straits Times reported that Mr Tan was cheated of US$19.2 million (S$25.8 million), Ms Pek of $5.5 million, and Mr Thio of more than $500,000. Another victim was former chief executive of fund manager Envysion Wealth Management (EWM), Veronica Shim, who herself lost $955,115.08, and was also cheated into delivering $47.3 million from EWM. Ms Shim testified in courts that she was fooled into believing Mr Ng Yu Zhi because he is a Singaporean who was well educated and brought up in Singapore, and his firm was licensed by MAS (Monetary Authority of Singapore), and also because she was duped by forged documents. Mr Ng Yu Zhi claimed that his firms would buy nickel from an Australian mine at a discount and sell the metal for a sizeable profit, but in reality, no nickel was bought or sold by his firms, and earlier investors were paid with the funds put in by other investors in a Ponzi scheme. In this case, prominent professionals and fund managers were being cheated and Ms Shim made a chilling statement in court as a reminder to everyone out there that it can happen to any one of you, whether or not you are a professional.

30-11-2024 (Sat) 8.15am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "本地股市受特朗普的增收关税的影响,和其他的国家比较,相对较小,股市的表现可能也不错。中国应对特朗普的增收关税已有经验,相信早有准备,其股市可能还会慢慢上涨,等到1月一切明朗化,才可能扶摇直上。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: "Compared with other countries, the local stock market is relatively less affected by Trump's increased tariffs, and may also perform well. China has experience in dealing with Trump's increased tariffs, and is well prepared in my opinion. China's stock market may continue to rise slowly, and may be heading for steady gains when there is clarity in January. "

25-11-2024 (Mon) 8.30am

宾夕法尼亚州的最后一个参议院席位落入共和党手中。这意味着共和党在100个参议院席位中占有53个多数席位控制着参议院,这将有助于确认特朗普的人事和司法任命。特朗普想对中国征收更多关税打压中国股市,但共和党控制了参议院和众议院也可意味着特朗普能有更多自由权与中国达成各方面的经济协议。 新加坡第三季度GDP同比强劲增长5.4%,高于预期的4.7%增长和上一季度的3.0%增长。这是自2021年第四季度以来最强劲的同比经济增长。新加坡今年经济增长的预测也从“2.0%至3.0%”上调至“3.5%左右”。然而,特朗普大肆宣扬的关税和地缘政治紧张局势的不确定性给予新加坡明年2025年的经济增长前景蒙上了阴影。即便如此,在特朗普政府正式上任,并提议对美国进口产品征收更多关税之前,国际贸易企业在关税正式实施之前赶着提前出口,这给予经济增长的提振是暂且的一个利好因素。 (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission. ) The last senate seat at Pennsylvania went to the Republicans. This means that the Republicans have a majority of 53 seats in the 100-seat Senate, which will be helpful in confirming Trump's personnel and judicial appointments. Trump's expected tariffs on China had weighed on Chinese stocks, but the Republicans' control over the Senate and the House could also mean Trump is at greater liberty in forging economic deals with China. Singapore's Q3 GDP growth came in strong at 5.4% year-on-year, higher than the expectations of a 4.7% growth, and the 3.0% growth in the previous quarter. This was the strongest year-on-year growth since the fourth quarter of 2021. The projection of Singapore’s economic growth this year was also raised to “around 3.5%,” from “2.0 to 3.0%”. However, the outlook for Singapore's economic growth in 2025 is clouded by uncertainties in Trump's touted tariffs and geopolitical tensions. Even then, the front-loading of exports ahead of the proposed tariffs on US imports under Trump’s administration will be a plus factor for the economy for the time being.

23-11-2024 (Sat) 8.15am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "中国商务部声称对特朗普大幅加大关税,中国有能力化解外部的冲击。 美国大选后,美股上涨,中港股市承压。不过中港股市下跌应是暂时性的,有大跌还是可以慢慢买进。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: "China's Ministry of Commerce claimed that China has the ability to resolve external shocks of Trump's significantly higher tariffs. After the US election, US stocks rose, and the Chinese and Hong Kong stock markets came under pressure. However, the decline in the Chinese and Hong Kong stock markets ought to be temporary, and you may still consider accumulating slowly if there be big declines. "

19-11-2024 (Tue) 8.15am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: " 股市还在调整中。大选年通常对美国股市有利,中长期被看好。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: " The stock market is still adjusting. Election years are usually good for the US stock market, and there is optimism in the medium and long term. "

16-11-2024 (Sat) 8.15am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: " 近期多家外资机构都在乐观地预测中国经济增长,并表示看好中国股市,上调中国股票评级。 野村首席中国经济学家陆挺上调了对中国第四季度GDP和全年GDP增长的预测。 瑞士百达资产管理将中国股票评级从“中性”上调至“超配”,理由是经济前景强劲。 中国出台提振经济和救市措施一个以后,消费、地产指标回暖,可能有望实现5%的经济增长。但在特朗普就任前,中国股市可能不会贸贸然上涨,但中长期还是被看好。 股市还在调整修正。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: " Recently, many foreign institutions have forecasted China's economic growth optimistically, having expressed optimism about the Chinese stock market, and upgraded the ratings of Chinese equities. Lu Ting, chief China economist at Nomura, raised his forecasts for China's fourth-quarter GDP and full-year GDP growth. Swiss Pictet Asset Management upgraded Chinese equities from "neutral" to "overweight" on the grounds of strong economic prospects. After China introduced stimulus measures to boost the economy and the stock market, consumption and real estate indicators rebounded, and it is hopeful that China may achieve its 5% economic growth. But before Trump takes office, China's stock market may possibly not rise too rashly, but there is still optimism for the Chinese market in the medium and long term. The stock market is still undergoing adjustment and consolidation. "

13-11-2024 (Wed) 8.00am

11-11-2024 (Mon) 10.30am

随着滨海湾金沙和亚洲各国的综合赌场度假胜地的竞争,云顶新加坡公布净利下降63%, 博彩收入下降28%,其股价上周五也下跌6%。今年 5 月,菲律宾新建了另一个综合赌场度假胜地,该国另外还有多达 8 个赌场项目正在规划中。据《海峡时报》报道,菲律宾预计 2024 年博彩总收入将达到 3360 亿比索(77.6 亿新元)的新高,比 2023 年创纪录的 2850 亿比索增长 18%,据菲利宾的预计已开始逼近我国年率博彩总收入。据报道,泰国也在推进赌场计划,而这些新的竞争者也将影响云顶新加坡股票的股价与情绪。云顶新加坡投入 68 亿新元 发展 圣淘沙名胜世界 2.0, 几项新景点将在 2025 年第一季度之前开幕。圣淘沙名胜世界 2.0 里头设有新的海滨开发项目,整个工程将分阶段完成,这对云顶新加坡的盈利贡献有多大,还有待观察。

(所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission. ) Amid competition from Marina Bay Sands, and integrated resorts in Asia, Genting Singapore announced a 63% drop in net profits with a 28% decline in its gaming revenue, and its share price dropped 5.4% last Friday. Another new integrated resort was built in the Philippines in May this year, and there are up to 8 more casino projects being planned in the Philippines. According to the Straits Times, the Philippines expects gross gaming revenue to reach a new high of 336 billion pesos (S$7.76 billion) in 2024, up 18% from 2023’s record 285 billion pesos, and is approaching Singapore's annual gross gaming revenue according to estimates from Philippines. Thailand is also reportedly forging ahead with casino plans, and all these new competitions will weigh on the sentiment and share price of Genting Singapore. The upcoming S$6.8 billion Resort World Sentosa (RWS) 2.0 development from Genting Singapore would see new attractions opened in Resort World Sentosa by the first quarter of 2025. The RWS 2.0, which includes a new waterfront development, will be completed in phases, and it remains to be seen how much it would contribute to the bottomline of Genting Singapore.

09-11-2024 (Sat) 8.00am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "中国十四届全国人大常委会第十二次会议审议通过近年来力度最大的化债举措,直接增加地方化债资源10万亿元。力度强大,将会提振经济和股市。 胜科工业(Sembcorp Industries)宣布出售全资子公司胜科环境(Sembcorp Environment)总交易金额预计为4亿零500万元,占公司市值的4.5%。交易价格相较6月30日胜科环境及其子公司账面及净资产值有43%的溢价。交易仍须获得监管批准,预计将在2025年上半年完成。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: " The Standing Committee of the 14th National People's Congress (NPC) concluded its 12th session on Friday, having approved the most powerful debt relief measures in recent years, directly increasing local government debt relief resources by 10 trillion yuan. The powerful measures announced will boost the economy and the stock market. Sembcorp Industries announced the sale of its wholly-owned subsidiary Sembcorp Environment (worth an expected total transaction value of $405 million, which accounted for 4.5% of the company's market value.) The transaction price is a 43% premium to the book and net asset value of Sembcorp Environment and its subsidiaries as of June 30. The transaction is still subject to regulatory approval and is expected to be completed in the first half of 2025. "

06-11-2024 (Wed) 8.15am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "中国股市不断传来好消息,提振中港股市大涨。中国总理李强周二上午在上海出席第七届中国国际进口博览会(进博会)开幕式时说,中央政府推出一系列增量政策后,说明中国政府有能力推动经济持续向好,因此中国对实现今年的经济发展目标充满信心。 中国不断大放救市措施,上证指数和沪深300指数在周二都收在四周高位。 10月财新中国通用服务业经营活动指数(服务业PMI)为52,高过9月1.7个百分点,为近三个月高点。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: "Good news continues to come out of China, boosting the Chinese and Hong Kong stock markets. Chinese Premier Li Qiang said at the opening ceremony of the 7th China International Import Expo (CIIE) in Shanghai on Tuesday morning that after the central government launched a series of incremental policies, it showed that the Chinese government has the ability to bring about the continued improvement of the economy, and China is full of confidence in achieving this year's economic targets. China continues to implement stimulus measures, and the Shanghai Composite Index and the CSI 300 Index both closed at a four-week high on Tuesday. In October, China's Caixin Services PMI came in at a near 3-month high of 52, rising 1.7 from the previous month's value in September. Hong Kong's S&P Global PMI rose from 50.0 in September to 52.2 in October, the highest in a year and a half, reflecting that the business environment in Hong Kong has begun to improve."

05-11-2024 (Tue) 8.00am

28-10-2024 (Mon) 8.30am

陈奕利先生今年早些时候曾多次建议买入新加坡本地股票,尤其是政联(government-linked)股票。(请参阅 2024 年 8 月 31 日、2024 年 8 月 9 日、2024 年 8 月 7 日、2024 年 3 月 26 日、2024 年 2 月 15 日、2024 年 1 月 25 日的 Ecomm 讯息)。8 月 9 日的股市讯息,他写道:“前景看来不错。我个人认为本地股价还在低点, 还是可以投资。” 8 月 31 日的股市讯息,他提到 “新加坡大选的脚步渐近,政联公司可注意” 让我们看看本地政联公司目前的股价表现: 星展银行:8月12日:$33.98 10月25日:$39.15(上涨 +15.2%) 吉宝:8月12日:$5.95 10月25日:$6.51(上涨 +9.4%) 新翔:8月12日:$3.03 10月25日:$4.01(上涨 +32.3%) 胜科:8月12日:$4.63 10月25日:$5.27(上涨 +13.8%) 新航:8月12日:$5.90 10月25日:$6.47(上涨 +9.7%) 新科工程:8月12日:$4.25 10月25日: $4.72 (上涨 +11.1%) 海指 8月12日:3235点 10月25日:3593点 (上涨 +11.1%)

由于股市已大幅上扬,再加上美国大选的不确定性以及中东紧张局势加剧,所以考虑有利现套利应该是没错的。

(所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission. ) Mr Tan Yi Li had repeatedly recommended the buying of local Singapore stocks earlier this year, especially the buying of government-linked stocks. (Please refer to Ecomm market updates in 31 Aug 2024, 9 Aug 2024, 7 Aug 2024, 26 Mar 2024, 15 Feb 2024, 25 Jan 2024). In the 9th August market update, he wrote that "the market outlook looks good. I personally think that local stock prices are still low, and we may still look to invest in local stocks." In the 31 August market update, he mentioned that "As the general election of Singapore approaches, we may look out for government-linked companies" Here is a look at how local government linked stocks had performed now (compared to in August): DBS: 12 Aug: $33.98 25 Oct: $39.15 (Up +15.2%) Keppel: 12 Aug: $5.95 25 Oct: $6.51 (Up +9.4%) SATS: 12 Aug: $3.03 25 Oct: $4.01 (Up +32.3%) Sembcorp: 12 Aug: $4.63 25 Oct: $5.27 (Up +13.8%) SIA: 12 Aug: $5.90 25 Oct: $6.47 (Up +9.7%) ST Eng: 12 Aug: $4.25 25 Oct: $4.72 (Up +11.1%) STI 12 Aug: 3235 pts 25 Oct: 3593 pts (Up +11.1%)

As the market has gone up much, and in the light of uncertainties in the U.S. elections and rising geopolitical tensions in the Middle East, it is never wrong to consider taking profits.

25-10-2024 (Fri) 8.00am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "国际货币基金组织预测新加坡2024年实际国内生产总值(GDP)将增长2.6%,2025年将增长2.5%。 两个预测值均高于国际货币基金组织在今年4月做出的预测,当时报告预测2024年和2025年的增速分别为2.1%和2.3%。显示新加坡的经济在好转中。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: "The International Monetary Fund (IMF) predicts that Singapore's real gross domestic product (GDP) will grow by 2.6% in 2024 and 2.5% in 2025. Both forecasts are higher than the previous forecast made by the IMF in April this year at the growth rates of 2.1% and 2.3% in 2024 and 2025 respectively. It showed that Singapore's economy is improving."

19-10-2024 (Sat) 7.45am

16-10-2024 (Wed) 8.00am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "中国和香港股市因之前涨势过急,现在在回调休正,实属正常,有了这些修正,现在我们已可开始投资,而中港股市还在低价位,中国还会继续出招,不会让牛市这样就结束。中国应可能会采取慢牛的走势,慢牛更好,因慢牛也是牛,而且是会走得更稳更没有风险。中港股市可能又即将再度吸引投资者的眼光。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: "The Chinese and Hong Kong stock markets are now correcting due to the last round of rapid rise. This is normal. With these corrections, we may look to start investing now. The Chinese and Hong Kong stock markets are still at a low price. China will continue to make moves and will not let the bull market end like this. China may adopt a slow bull trend. A slow bull is better because a slow bull is also a bull, and it will be more stable and less risky. The Chinese and Hong Kong stock markets may once again attract investors' attention. "

14-10-2024 (Mon) 8.00am

以下是辉立证券首席股票经纪陈奕利先生的股市分析: "中国财政部宣布将在今明两年推出一批成熟、可感可及的深化财税体系改革举措。将抓紧出台深化财税体制改革实施方案,加快推进改革和推动财政科学管理和有机结合,积极回应社会和基层关切。 中国财长声称中央财政还有较大举债和赤字提升空间。 中国财长还声称中国财政可完成全年预算目标。 中国将加大力度解决地方隐性债问题,计划一次性增加较大规模债务限额,置换地方政府隐性债务。 中国财政部宣布将允许专项债券回收闲置存量土地、也将收购商品房用作保障性住房,以促进房地产市场供需平衡。 中国周六出大招,几乎涵盖所有的难题,如果落实,实必会使股市再度大涨。" (所提供的本文只供参考, 投资买卖,必须審慎,自负责任。版权所有,未经允许,禁止转载。) ( All contents provided are for informational purposes only. Access to and the use of the contents are at the user's own risk. You should assess your situation and risk tolerance, and do your own due diligence before making any investment decisions. All losses and costs associated with investing are your responsibility. All rights reserved. This material may not be published, broadcast, or redistributed without permission.) The following is the market analysis by Phillip Securities Principal Remisier Mr Willie Tan Yi Li: "China's Ministry of Finance announced that it will launch a batch of fiscal and tax reforms in the next two years, will promptly issue an implementation plan to accelerate the reforms, and will actively respond to social and grassroots concerns. China's Finance Minister claimed that the central government still has "large room" for fiscal stimulus. China's Finance Minister also claimed that China's finances can fully meet the annual budget target. China will increase its efforts to solve the problems of hidden debts of local governments, and plans to increase the debt ceiling on a large scale in one lump sum to replace the existing hidden debts of the local governments. China's Ministry of Finance announced that it will allow the use of special bonds to reclaim idle stock land, purchase existing commercial housing, promote the supply of affordable housing, and alleviate inventory risks in the real estate market. China made a big move on Saturday, covering almost all the problems. If implemented, it will surely provide a boost to the stock markets to rise further."

12-10-2024 (Sat) 8.15am